Everyone is excited to know that what are these big income tax rule that will changes from FY 2023-24, here is the details of that 10 big changes:-

The new tax regime will be the default regime if a person does not state which regime they will submit their returns under this.

As the new financial year 2023-24 approaches, taxpayers in India will be affected by several changes to the income tax rules.

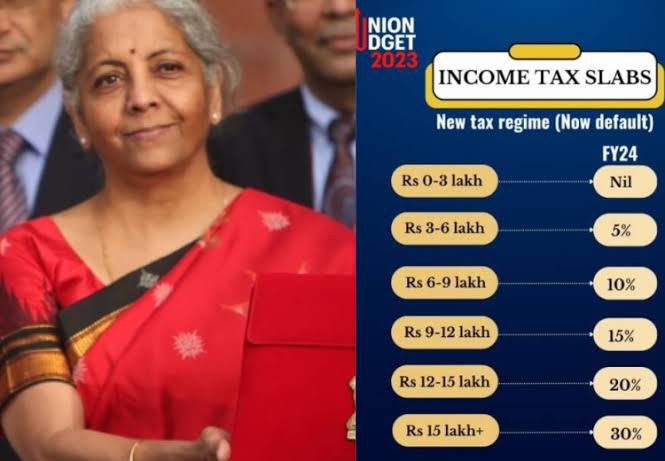

The changes were announced by Union Finance Minister Nirmala Sitharaman during the annual Union Budget in February.

Here are the 10 most significant changes to look out for:

1. Default tax regime: The new tax regime will be the default regime if a person does not state which regime they will submit their returns under.

2. Tax rebate limit raised: The rebate limit has been increased from Rs 5 lakh to Rs 7 lakh.

3. Income tax slabs:

The new tax rates range from 0% to 30%.

Yearly salary up to 3 lakh: Nil

Yearly Salary 3 lakh to 6 lakh: 5%

Yearly salary 6 lakh to 9 lakh: 10%.

Yearly salary 9 lakh to 12 lakh: 15%.

Yearly salary 12 lakh to 15 lakh: 20%.

Above 15 lakh: 30%.

4. Standard deduction: The deduction of Rs. 50,000 under the old regime remains unchanged and has been extended to the new regime.

5. LTA: The leave travel allowance encashment limit has been raised from Rs. 3 lakh to Rs 25 lakh.

6. Physical gold conversion: No capital tax gain if physical gold is converted to Electronic Gold Receipt (EGR), or vice-versa.

7. No LTCG tax benefits: Investment in debut mutual funds will be taxed as short-term capital gains instead of long-term capital gains.

8. Market-linked debentures: Investment in MLDs will be considered short-term capital assets.

9. Life insurance policies: Proceeds from life insurance premium over the annual premium of Rs. 5 lakh will be taxable.

10. Benefits for senior citizens: Maximum deposit limit under senior citizens savings scheme extended to Rs 30 lakh from Rs 15 lakh. The government has also extended several benefits to senior citizens, including an increase in the maximum deposit limit under senior citizens savings schemes and monthly income schemes.These changes will have a significant impact on taxpayers in India, particularly those who earn less than Rs 7 lakh per year, as they will benefit from an increased rebate limit. However, investors in debut mutual funds and market-linked debentures will no longer have access to long-term tax benefits, which could have a slightly negative impact on the mutual fund industry.